DIN Network

Block

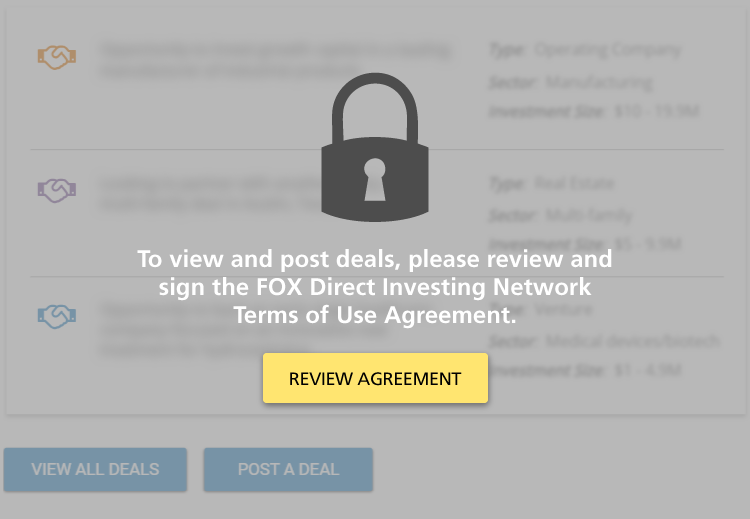

The Direct Investing Network is for families actively engaged in direct investing who want to share information, deals, and experiences with other active investors.

Terms of Use

Block

Block

DIN Network Sponsorship

Contact Tim to learn about sponsorship opportunities.

Block

Investment Deals

Investment in Food Hall Operating Business

Bluestem Market is a vibrant new food hall concept designed to fuel local culinary talent while redefining the dining experience. Featuring 8 vendor spaces, it provides an accessible launchpad for food artisans to showcase their craft—without the…

Sector: Hospitality & Leisure

Investment Size: $5 - 9.9M

Multifamily Real Estate Development Opportunity

LCI Development Partners, the affiliated real estate investment and Development arm of AWC, is currently sourcing $18.9 million in limited partner capital for a 138 unit multifamily development in Downers Grove, IL.

Sector: Real Estate

Investment Size: $10 - 19.9M

300-Unit Multifamily Acquisition - Phoenix, AZ

Brixton Capital has been awarded the acquisition of the Alta Warehouse apartment complex in Phoenix, AZ for $82 million / 273K per door / $290 PSF.

Alta Warehouse is a 300-unit, 4-story, elevator-served apartment community in the…

Sector: Real Estate

Investment Size: $30 - 39.9M

Multifamily Real Estate Investment Opportunity - (Denver MSA)

We are acquiring a first-class apartment community in Lakewood, Colorado, called the Windsor (the "Property") directly from the seller in an off-market transaction. The purchase price is $125 million ($320 PSF), representing a 5.67% cap…

Sector: Real Estate

Investment Size: $1 - 4.9M

Multifamily Real Estate Investment Opportunity - Lake Mary (Orlando MSA), FL

LCI Development Partners is seeking a $9MM limited partner equity investment to construct a 70-unit boutique luxury multifamily project within walking distance to local grocers, restaurants, and other area amenities.

The project is located in the…

Sector: Real Estate

Investment Size: $5 - 9.9M

Upcoming SpaceX Tender Offer Direct from Company

Please see below SpaceX opportunity for Family Office Exchange members.

SpaceX will be running a Tender Offer at year end, which occurs every 6 months for employees. The shares are classified as common. There is no difference…

Sector: Venture Capital

Investment Size: $50M+

AgNovos Bioscience - A Regenerative Technology Company, Pioneering Novel Treatments for Bone Disease

We are raising up to $60mm of funding at a $300mm pre-money valuation in a Series B Preferred Stock. The goal for the company to have an IPO in late 2026. The family has invested over $200mm into this company and will be investing in the…

Sector: Venture Capital, Medial Devices/ Biotech

Investment Size: $50M+

Preferred Equity Investment - new branded top tier extended-stay hotel in countercyclical major market

Opportunity to co-invest in a preferred equity position (insulated downside risk) to facilitate the acquisition of a sought after extended-stay branded hotel in the downtown heart of a major Mid-Atlantic market. $6MM total investment…

Sector: Hospitality

Investment Size:

Sports Tech Investment Platform Co-Investment Opportunity

We’re offering a unique opportunity to co-invest in our sports tech investment platform alongside elite professional athletes.

Our platform supports passionate, smart and nice entrepreneurs who are building game-changing tech companies in the…

Sector: Operating company

Investment Size:

Leading travel app - Series E financing

Opportunity to invest up to $5 million in the $120 million Series E financing for largest global seller of air travel on mobile, with over 30 million downloads and $700 million of travel bookings. Key performance indicators are extremely compelling…

Sector: Venture Capital

Investment Size:

Leading Legal Sports Betting Company

Seeking $2 to 17 million for investment in Series F financing of the one of the largest legalized sports betting companies in the US. The financing is being led by a prominent investment firm.

As an indirect founding investor in the…

Sector: Retail/ Consumer

Investment Size:

Single Family Rental (SFR) Portfolio Investment - Southeast FL

Our family operating business has identified a Single Family Rental real estate portfolio in Southeast Florida and is seeking co-investment from other family offices. Our company purchases newly completed construction…

Sector: Real Estate

Investment Size:

Fin Tech Opportunity

We are invested in a company utilizing blockchain technology to deliver solutions that permit the frictionless and instantaneous trading, settlement, collateralization and clearing of transactions in both traditional currencies and…

Sector: Technology

Investment Size:

Alternative Investments Mutual Fund & ETF Platform

We have developed an investment platform which brings sophisticated alternative investment strategies typically only used by institutional investors to retail investors in the form of liquid alternative mutual funds and ETFs. In a short…

Sector: Financial Services

Investment Size:

Autonomous driving: perception solution

Our single family office is currently evaluating several technologies/deal opportunities that aim at enabling cars to perceive their environment in 3D.

Deal #1 is a series B round in a company that has a market ready & full fledged…

Sector: Venture Capital

Investment Size:

Cell Tower Fund Co-Investment

This co-investment is with a third party fund that provides equity to select developers in the cell tower space. We have a great deal of experience with the fund sponsor. Approved carrier leases are required prior to each tower…

Sector: Other

Investment Size:

Single Family Rental Co-GP Opportunity

We are an experienced rental housing operated based in Florida, and have been in the business since 2008. We have been recognized by Harvard Business School for our innovative and technology-driven approach in single-family home rental housing and…

Sector: Single Family

Investment Size:

Pagination

- Previous page

- Page 7

- Next page

Block

Network Member Discussions: FOXChat

Block

Upcoming Events

There are no events of this type at this time.

Tim Duffy

Tim Duffy