DIN Network

Block

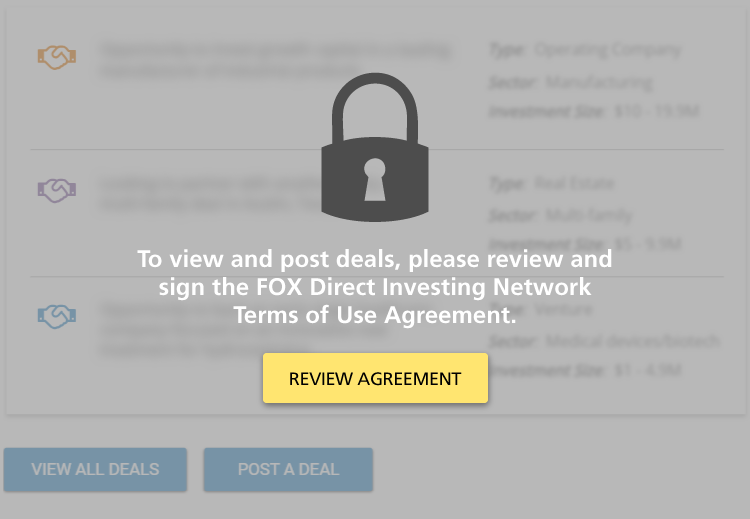

The Direct Investing Network is for families actively engaged in direct investing who want to share information, deals, and experiences with other active investors.

Terms of Use

Block

Block

DIN Network Sponsorship

Contact Tim to learn about sponsorship opportunities.

Block

Investment Deals

Investment in Food Hall Operating Business

Bluestem Market is a vibrant new food hall concept designed to fuel local culinary talent while redefining the dining experience. Featuring 8 vendor spaces, it provides an accessible launchpad for food artisans to showcase their craft—without the…

Sector: Hospitality & Leisure

Investment Size: $5 - 9.9M

Multifamily Real Estate Development Opportunity

LCI Development Partners, the affiliated real estate investment and Development arm of AWC, is currently sourcing $18.9 million in limited partner capital for a 138 unit multifamily development in Downers Grove, IL.

Sector: Real Estate

Investment Size: $10 - 19.9M

300-Unit Multifamily Acquisition - Phoenix, AZ

Brixton Capital has been awarded the acquisition of the Alta Warehouse apartment complex in Phoenix, AZ for $82 million / 273K per door / $290 PSF.

Alta Warehouse is a 300-unit, 4-story, elevator-served apartment community in the…

Sector: Real Estate

Investment Size: $30 - 39.9M

Multifamily Real Estate Investment Opportunity - (Denver MSA)

We are acquiring a first-class apartment community in Lakewood, Colorado, called the Windsor (the "Property") directly from the seller in an off-market transaction. The purchase price is $125 million ($320 PSF), representing a 5.67% cap…

Sector: Real Estate

Investment Size: $1 - 4.9M

Multifamily Real Estate Investment Opportunity - Lake Mary (Orlando MSA), FL

LCI Development Partners is seeking a $9MM limited partner equity investment to construct a 70-unit boutique luxury multifamily project within walking distance to local grocers, restaurants, and other area amenities.

The project is located in the…

Sector: Real Estate

Investment Size: $5 - 9.9M

Upcoming SpaceX Tender Offer Direct from Company

Please see below SpaceX opportunity for Family Office Exchange members.

SpaceX will be running a Tender Offer at year end, which occurs every 6 months for employees. The shares are classified as common. There is no difference…

Sector: Venture Capital

Investment Size: $50M+

AgNovos Bioscience - A Regenerative Technology Company, Pioneering Novel Treatments for Bone Disease

We are raising up to $60mm of funding at a $300mm pre-money valuation in a Series B Preferred Stock. The goal for the company to have an IPO in late 2026. The family has invested over $200mm into this company and will be investing in the…

Sector: Venture Capital, Medial Devices/ Biotech

Investment Size: $50M+

Regenerative Medicine Biologic Platform Technology

Our family office has invested in a company that has created a unique and highly innovative patented technology based on biologically active materials manufactured from allogenic human blood plasma. These Plasma-based Bioactive Materials (PBMs)…

Sector: Medial Devices/ Biotech

Investment Size:

FinTech Company

The Company was founded by a group of senior executives from global alternative asset managers and technology firms. The founders’ collective experience totals more than 100 years in senior roles at leading financial services and technology…

Sector: Technology

Investment Size:

Privacy Control Company for Large Corporations and Consumers

The Company was spun off as a new entity in June of 2019 after years of product development by a predecessor company and has created a patent pending global scalable solution for big corporations and consumers alike in response to recent laws passed…

Sector: Technology

Investment Size:

Pharmacogenetics Testing Company Focused on Pain Management

The company is the first and only company focused on using genetics for pain management, providing clients with useful insights about compatibility for pain and related treatment. The company looks specifically at 116 variants on 55 genes to make a…

Sector: Medial Devices/ Biotech

Investment Size:

Hospitality Investments - Austin, Texas and San Francisco, California

My company is developing two new hotels in 2019 both with major flags. The first being in Austin, Texas on Congress Street near the Capital and the second in downtown San Francisco between the Moscone Center and the new Salesforce Tower. The two…

Sector: Real Estate

Investment Size:

CALAMAR LIFESTYLE SENIOR HOUSING FUND, LLC

Investment objective: Provide investors with equity ownership in a portfolio of senior residential properties. Senior housing has been, and is expected to continue to be, one of America’s fastest growing and most stable real property market…

Sector: Senior living

Investment Size:

Light weighting steel alloy for the transportation industry

The Company is an advanced materials company specializing in the design and commercialization of patented steels with exceptional mechanical properties derived from their nano-scale microstructure. The Company’s primary focus is proprietary alloys…

Sector: Technology

Investment Size:

Disruptive event-based machine vision technology

The Company addresses the problem of machine vision in the context of automotive, industrial automation, robotics and AR/VR. The solution it developed is based on a paradigm change: instead of processing a scene frame by frame (like…

Sector: Technology

Investment Size:

Sale of Texas QSR Properties - NNN Investment Opportunity

Opportunity to purchase three, new development, quick service restaurant (QSR) properties.

This is an NNN investment with new 20-year leases on all properties. The sites are located in Texas and are operated by a top performing,…

Sector: Real Estate

Investment Size:

Ulta Short Term Transactional Real Estate Funding

High-level Summary:

In December, we closed on acquiring 45% of a company called Marquee Funding that does ultra short-term financing for single family and commercial real estate to wholesalers for immediate flips. Generally, Marquee …

Sector: Operating company

Investment Size:

Pagination

- Previous page

- Page 5

- Next page

Block

Network Member Discussions: FOXChat

Block

Upcoming Events

There are no events of this type at this time.

Tim Duffy

Tim Duffy