DIN Network

Block

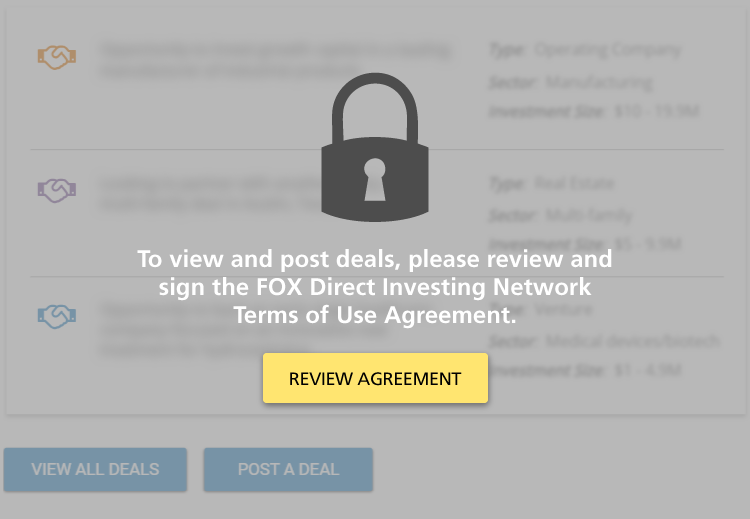

The Direct Investing Network is for families actively engaged in direct investing who want to share information, deals, and experiences with other active investors.

Terms of Use

Block

Block

DIN Network Sponsorship

Contact Tim to learn about sponsorship opportunities.

Block

Investment Deals

Investment in Food Hall Operating Business

Bluestem Market is a vibrant new food hall concept designed to fuel local culinary talent while redefining the dining experience. Featuring 8 vendor spaces, it provides an accessible launchpad for food artisans to showcase their craft—without the…

Sector: Hospitality & Leisure

Investment Size: $5 - 9.9M

Centurion Luxury Homes, Paradise Valley, Arizona

Overview:

SAM Homes Group, the affiliated real estate investment and housing development arm of Drewlo Holdings is transforming a prime 1.01-acre Paradise Valley parcel into an ultra-luxury estate that sets a new benchmark for high-end living.…

Sector: Real Estate

Investment Size:

Multifamily Real Estate Development Opportunity

LCI Development Partners, the affiliated real estate investment and Development arm of AWC, is currently sourcing $18.9 million in limited partner capital for a 138 unit multifamily development in Downers Grove, IL.

Sector: Real Estate

Investment Size: $10 - 19.9M

300-Unit Multifamily Acquisition - Phoenix, AZ

Brixton Capital has been awarded the acquisition of the Alta Warehouse apartment complex in Phoenix, AZ for $82 million / 273K per door / $290 PSF.

Alta Warehouse is a 300-unit, 4-story, elevator-served apartment community in the…

Sector: Real Estate

Investment Size: $30 - 39.9M

Multifamily Real Estate Investment Opportunity - (Denver MSA)

We are acquiring a first-class apartment community in Lakewood, Colorado, called the Windsor (the "Property") directly from the seller in an off-market transaction. The purchase price is $125 million ($320 PSF), representing a 5.67% cap…

Sector: Real Estate

Investment Size: $1 - 4.9M

Multifamily Real Estate Investment Opportunity - Lake Mary (Orlando MSA), FL

LCI Development Partners is seeking a $9MM limited partner equity investment to construct a 70-unit boutique luxury multifamily project within walking distance to local grocers, restaurants, and other area amenities.

The project is located in the…

Sector: Real Estate

Investment Size: $5 - 9.9M

Upcoming SpaceX Tender Offer Direct from Company

Please see below SpaceX opportunity for Family Office Exchange members.

SpaceX will be running a Tender Offer at year end, which occurs every 6 months for employees. The shares are classified as common. There is no difference…

Sector: Venture Capital

Investment Size: $50M+

AgNovos Bioscience - A Regenerative Technology Company, Pioneering Novel Treatments for Bone Disease

We are raising up to $60mm of funding at a $300mm pre-money valuation in a Series B Preferred Stock. The goal for the company to have an IPO in late 2026. The family has invested over $200mm into this company and will be investing in the…

Sector: Venture Capital, Medial Devices/ Biotech

Investment Size: $50M+

Active Adult Senior Housing Direct Investment Opportunity

55+ Retirement Communities have launched with huge fanfare and strong returns. Calamar is both and pioneer and leader in this market segment. Calamar is growing the portfolio nationally for a public exit. We are looking for shoulder to sholder…

Sector: Real Estate, Senior living

Investment Size: $0 - 0.9M

Opportunity Zone Investment in Detroit

Woodward West is a $60.4 million-dollar development of a 1.85-acre parcel in Midtown Detroit and qualifies as an Opportunity Zone investment. The development

The devlopment is well-positioned in the heart of Detroit’s activity, walking…

Sector:

Investment Size: $0 - 0.9M

Nashville Multifamily Acquisition, Opportunity Zone, 322-units

The Max Collaborative is acquiring a 322-unit apartment community in Nashville, TN. We are investing $11 million (or 25% of the equity) and are looking for other families to invest $32 million (or 75% of the equity). The community is newly built and…

Sector:

Investment Size: $30 - 39.9M

Preferred Investment in Mixed-Use Development – Washington D.C.

We are the lead investor in a premier mixed-use infill development project in the dynamic NoMa neighborhood of Washington D.C. The project consists of a 500-unit market rate apartment building with two wings connected by a rooftop skybridge,…

Sector: Real Estate

Investment Size: $5 - 9.9M

Chemical Distribution Platform -Direct Investment Opportunity

Executive Summary

Akoya is pursuing a buy-and-build investment strategy in the specialty chemical distribution space with the goal of creating a $300MM+ super-regional chemical distribution company and has recently executed an exclusive LOI, on a…

Sector:

Investment Size: $20 - 29.9M

Project Canary - Series E - Venture Capital - The Next Cardiology Mega Market - Transcatheter Tricuspid Valve Treatment

"Project Canary " is seeking its Series E financing and is raising funds for the company's Early Feasibility Study in the U.S. which has received approval from the F.D.A. The company has completed 6 cases in Europe and is…

Sector:

Investment Size: $5 - 9.9M

Digital Real Estate Development and Launch Initiative

Digital real estate (revenue-producing websites) is an expanding industry which is gaining considerable new M&A attention amidst the aggregator and ecommerce sectors. In partnership with a team of digital content and development experts, Kaztex…

Sector:

Investment Size: $0 - 0.9M

394-unit conventional multi-family development next to TopGolf in Meridian, Idaho

Ball Ventures, LLC seeks up to $15MM in limited partner investment related to a 394-unit conventional multi-family development.

Development is located within an exciting master-planned development which includes two recently constructed office…

Sector: Real Estate

Investment Size: $10 - 19.9M

Entertainmint - A web3 native ecosystem for producing and monetizing TV, movies, and video

Entertainmint.live is one-stop-shop for creating, monetizing, and fostering community around indie content. We put both the viewer and the creator in the driver’s seat when it comes to independent video. Our platform leverages blockchain…

Sector: Operating company, Technology

Investment Size: $1 - 4.9M

DroneView Technologies

DroneView Technologies - much more than “ Just Drones” - is a leading aerial mapping and geospatial services company. DroneView provides precision mapping solutions - aerial imagery & LiDAR from both manned aircraft & drones to survey/…

Sector: Operating company, Business Services

Investment Size: $1 - 4.9M

Pagination

- Previous page

- Page 3

- Next page

Block

Tim Duffy

Tim Duffy