DIN Network

Block

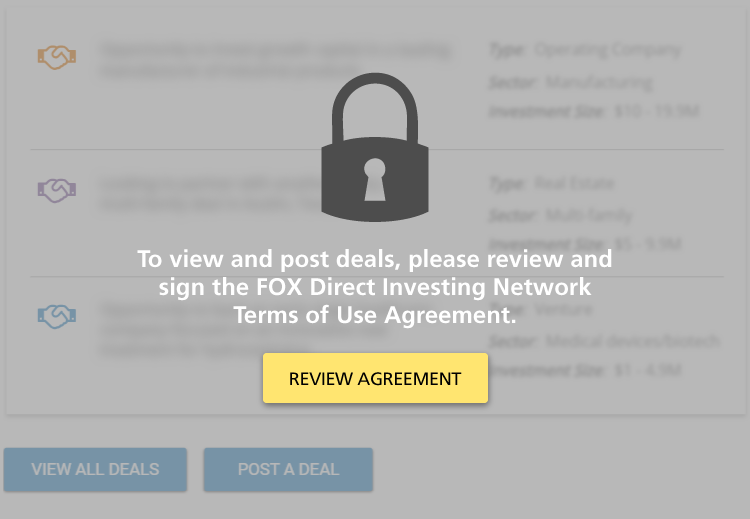

The Direct Investing Network is for families actively engaged in direct investing who want to share information, deals, and experiences with other active investors.

Terms of Use

Block

Block

DIN Network Sponsorship

Contact Tim to learn about sponsorship opportunities.

Block

Investment Deals

Investment in Food Hall Operating Business

Bluestem Market is a vibrant new food hall concept designed to fuel local culinary talent while redefining the dining experience. Featuring 8 vendor spaces, it provides an accessible launchpad for food artisans to showcase their craft—without the…

Sector: Hospitality & Leisure

Investment Size: $5 - 9.9M

Centurion Luxury Homes, Paradise Valley, Arizona

Overview:

SAM Homes Group, the affiliated real estate investment and housing development arm of Drewlo Holdings is transforming a prime 1.01-acre Paradise Valley parcel into an ultra-luxury estate that sets a new benchmark for high-end living.…

Sector: Real Estate

Investment Size:

Multifamily Real Estate Development Opportunity

LCI Development Partners, the affiliated real estate investment and Development arm of AWC, is currently sourcing $18.9 million in limited partner capital for a 138 unit multifamily development in Downers Grove, IL.

Sector: Real Estate

Investment Size: $10 - 19.9M

300-Unit Multifamily Acquisition - Phoenix, AZ

Brixton Capital has been awarded the acquisition of the Alta Warehouse apartment complex in Phoenix, AZ for $82 million / 273K per door / $290 PSF.

Alta Warehouse is a 300-unit, 4-story, elevator-served apartment community in the…

Sector: Real Estate

Investment Size: $30 - 39.9M

Multifamily Real Estate Investment Opportunity - (Denver MSA)

We are acquiring a first-class apartment community in Lakewood, Colorado, called the Windsor (the "Property") directly from the seller in an off-market transaction. The purchase price is $125 million ($320 PSF), representing a 5.67% cap…

Sector: Real Estate

Investment Size: $1 - 4.9M

Multifamily Real Estate Investment Opportunity - Lake Mary (Orlando MSA), FL

LCI Development Partners is seeking a $9MM limited partner equity investment to construct a 70-unit boutique luxury multifamily project within walking distance to local grocers, restaurants, and other area amenities.

The project is located in the…

Sector: Real Estate

Investment Size: $5 - 9.9M

Upcoming SpaceX Tender Offer Direct from Company

Please see below SpaceX opportunity for Family Office Exchange members.

SpaceX will be running a Tender Offer at year end, which occurs every 6 months for employees. The shares are classified as common. There is no difference…

Sector: Venture Capital

Investment Size: $50M+

AgNovos Bioscience - A Regenerative Technology Company, Pioneering Novel Treatments for Bone Disease

We are raising up to $60mm of funding at a $300mm pre-money valuation in a Series B Preferred Stock. The goal for the company to have an IPO in late 2026. The family has invested over $200mm into this company and will be investing in the…

Sector: Venture Capital, Medial Devices/ Biotech

Investment Size: $50M+

Senior Living Real Estate Opportunity in Mason, OH (btwn Cincinnati & Dayton)

We are seeking LP members to invest in a senior living development in Mason, Ohio. Marcus Investments has teamed with a national senior living operator and together have identified an opportunity to develop a ground up, 41 unit assisted living and…

Sector: Senior living

Investment Size:

Senior Living Opportunity in Mason, OH

Berengaria Development, the in-house real estate development and investment arm of Marcus Investments, together with BrightStar Senior Living (BSL), have identified an opportunity to develop a ground up, 41 unit assisted living and memory care…

Sector: Real Estate

Investment Size:

Retail Real Estate Investment Opportunity in St. Joseph, MO

We are seeking LP members to invest in a retail regional power center in St. Joseph, MO located 45 minutes north of Kansas City. The Shoppes at North Village is a multi-tenant retail shopping center with an exceptional mix of junior boxes and small…

Sector: Real Estate

Investment Size:

Retail Real Estate Investment Opportunity in Holland, Michigan

We are seeking LP members to invest in a retail regional power center in Holland, Michigan. The property is located 36 miles southwest of Grand Rapids, MI. The property is a multi-tenant retail shopping center with an exceptional tenant mix of…

Sector: Real Estate

Investment Size:

Future-Of-Work Company with ERP and Insurance Benefits

While the robots are coming, many now believe that the future of work involves humans and machines. This company is perfectly positioned for this trend and has 16+ customers including a branch of the US military, a major retailer, a major user/…

Sector: Venture Capital

Investment Size:

Industrial Real Estate Development in Atlanta and Greenville/Spartanburg

We are seeking LP memebers to invest in the development of two industrial buildings in both Atlanta, Georgia and Greenville/Spartanburg, South Carolina (4 total buildings). The Atlanta buildings are located in the Fulton Industrial…

Sector: Industrial

Investment Size:

Value Add Oceanfront Development Deal in Booming Boston Submarket

Premier 75-Unit Multifamily Development in booming Revere, Massachusetts, located just 5 miles North of Downtown Boston. Revere is just beginning to experience massive expansion and economic activity with the planned developments at…

Sector: Real Estate

Investment Size:

Opportunity Zone Development in Austin TX

22 Acre site in Austin TX that is in opportunity zone. Seeking $60 million for land acuisition and site work. The land will be developed with mixed use, multifamily, office, and retail of over 5 million square feet.

Sector: Real Estate

Investment Size:

Regenerative Medicine Platform Technology - Phase III Biologic that promotes natural healing

Our famiy office has invested in a company that has created a unique and highly innovative patented technology based on biologically-active materials manufactured from allogenic human blood plasma. These Plasma-based Bioactive Materials (…

Sector: Medial Devices/ Biotech

Investment Size:

476 Unit Value-Add Multifamily in Dallas/Ft Worth area

An investment opportunity for the purchase and renovation of a 476 unit apartment project in Irving, Texas. Property was built in 1985. The Dallas/Ft. Worth MSA remains a very dynamic market with excellent employment…

Sector: Multi-family

Investment Size:

Pagination

- Previous page

- Page 6

- Next page

Block

Tim Duffy

Tim Duffy