Empowering the Rising Generation: Why Estate Planning Must Include Education

Empowering the Rising Generation: Why Estate Planning Must Include Education

Mindy Kalinowski Earley | March 1, 2025

Full article titled “Rising Gen Engagement and Education: An Essential Component of the Estate Planning Process” published in Investments & Wealth Review (March/April 2025), by The Investments & Wealth Institute®.

The largest intergenerational wealth transfer in history—over $84 trillion—is underway. But here’s the catch: only 1 in 5 affluent investors stick with their parents’ financial advisor. Why? Because the rising generation (or “rising gen”) wants more than just wealth—they want understanding, clarity, and a voice in the process.

If you're a financial advisor, estate planner, or part of a high-net-worth family, this is your chance to take positive action: education and engagement are no longer optional—they’re essential.

What the Rising Gen Really Want

Today’s rising gen challenge the stereotype of entitled heirs. They are curious, capable, and craving clarity. According to research by Family Office Exchange (FOX) and Northern Trust, here’s what they value most:

- Clear expectations and defined roles within the family and enterprise.

- Hands-on learning—not just lectures, powerpoints or technical jargon.

- Inclusion in decision-making, from family meetings to philanthropy boards.

“Our parents built this from the ground up so they just know what to do, inherently. As we’re trying to figure out our next roles I feel personally I would really love some kind of roadmap and some very black and white explanation as to why things work the way they do and how I know what to do and when to do it.” — Rising Gen Focus Group Participant

Learning That Sticks: Best Practices for Educating the Rising Gen

1. Meet Them Where They Are

Use teachable moments that align with their life stage. Whether it’s a first job, a marriage, or a new investment, timing matters

2. Make It Experiential

Edgar Dale’s “Cone of Experience” shows that people retain more when they do, not just hear. Encourage participation in:

- Family and advisor meetings

- Board and committee service

- Industry workshops and forums

3. Repeat and Reinforce

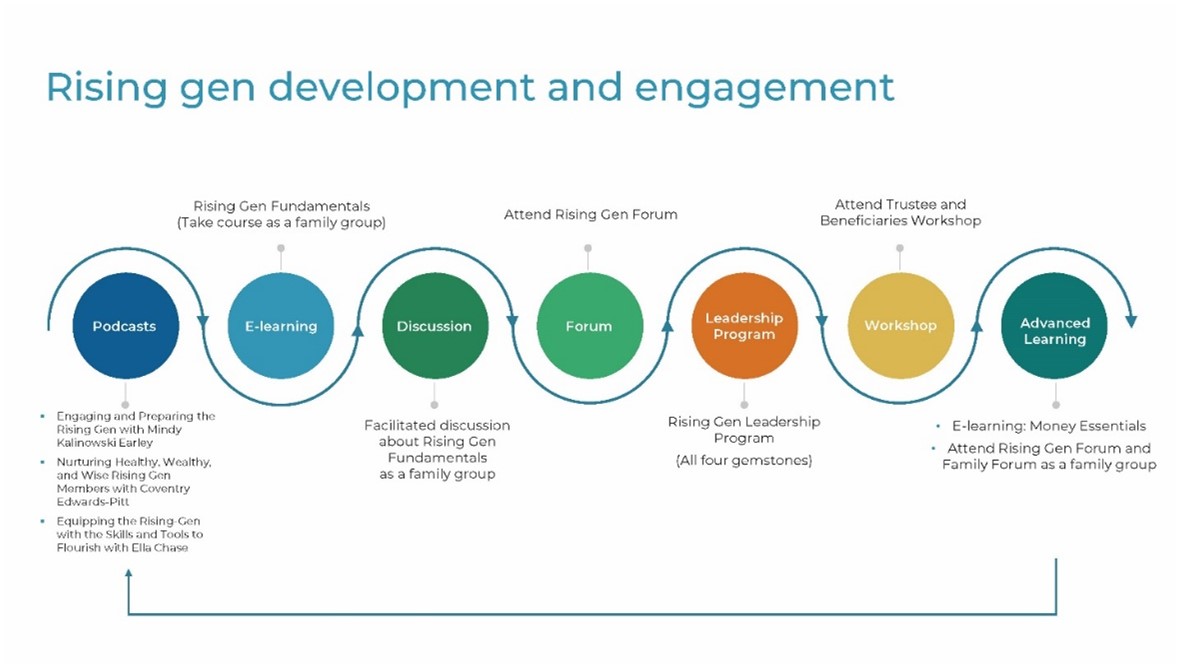

Learning takes repetition and the delivery matters. Make it experiential, focus on applied learning. Deliver learning through podcasts, books, rising gen events, or e-learning courses - to reinforce key concepts over time.

This model presents a sample learning journey for rising gen development and engagement, with a variety of learning styles and engagement opportunities.

Pro Tips for Advisors and Families

- Start early: Industry models suggest starting learning as early as age five. You can teach stewardship through everyday responsibilities—even caring for a pet.

- Clarify roles: Make no assumptions about what rising gen know. Instead, ask them, and use that as the springboard for the learning development. Be clear in spelling out expectations.

- Use Agendas: Prepare beneficiaries for meetings with pre-reads and clear objectives.

- Honor Individuality: Their path may not mirror their parents’. Support their unique journey.

Tools & Resources to Get Started

Here are some standout resources for families and advisors:

- FOX Trustee & Beneficiary Workshop – A unique industry event for both parties to learn together.

- Tamarind Learning – Flexible online courses on stewardship and trust fundamentals.

- Books:

- Podcasts:

The Bottom Line

The “black box” approach to estate planning—where details are hidden or assumed—no longer works. The rising gen wants to understand, contribute, and lead. By investing in their education and engagement, you’re not just preparing them for inheritance—you’re preparing them to be educated stewards, with an empowered desire to engage in the family system.

“Help the rising gen on their path by providing context that leads to comprehension.”